Review Mobile Card Reader for Android Phones & Tablets

Best mobile credit menu processors of 2022

The all-time mobile credit menu processors make information technology simple and easy to take payments by credit and debit card in a store, at a trade off-white, or on the go.

Taking menu payments is increasingly essential for whatever modern business organization, but what happens if you lot want to sell at a trade fair, fix up a market stall or popular-upwards shop, or swipe a credit bill of fare tableside in a restaurant?

This is where mobile card readers come into their own for credit card processing, allowing you lot to take card payments wirelessly and on the go. You don't need a checkout till, yous just need a smartphone or tablet that tin run apps to connect with a mobile carte du jour reader.

They can even be keen for small mom-and-pop shops that are looking to continue their initial costs downwards, and a tablet running apps on a stand up can work in lieu of a till.

Credit card readers are the front end to your signal of auction (POS) arrangement, which can practise much more than simply read cards. The best POS systems tin can manage your inventory, ensure yous're on top of compliance-related payment regulations, and help your business organization avoid fines and other administrative costs (such as chargeback fraud), all while offer advanced security features that protect from data theft and cyber breaches.

Where mobile credit card processing really comes into its ain is its sheer flexibility. Using nothing more than your smartphone, a downloaded app, and a cheap card reader costing from $25 to $l, y'all can have payments anywhere at that place is a cellular network signal. And some merchants offering an offline selection to kick.

Even improve, it's not merely the ability to accept payments from credit/debit cards with an EMV aka chip-and-pivot, but contactless payments can now also be taken, including Apple Pay, Android Pay, and Samsung Pay.

About merchant services providing a mobile card reader offering rates similar to online payment processing systems. Many charge no monthly fee, just transaction fees in the range of 2.5-3.5%. In that location are options to pay a monthly fee in order to reduce transaction fees downwards to interchange fees only, i.e. the pennies the banking company will charge for movement of funds between accounts.

Here nosotros look at some of the merchant service providers who can provide the best in mobile card readers for taking payments on the go.

Nosotros've likewise showcased the best accounting software for minor business and best tax software .

Foursquare provides a range of innovative POS solutions, and their mobile bill of fare reader continues this policy. As with Foursquare's products in general, your mobile device tin serve as a checkout and sales center for your retail business concern, and the menu reader remains an integral part of that.

The card reader itself is just a small device that clicks onto your smartphone via a Lightning USB connection for iPhones and iPads, or phone jack connection for Android phones. The zipper tin and then have cards only swiped through it to be processed.

The swiping process is easy, only information technology's besides secure with no card or customer information being stored in your phone. Instead it's sent over an encrypted connexion for processing, and and so that'south the processing done.

The basic bill of fare reader itself is complimentary, and transaction fees are a flat-charge per unit for Visa, Mastercard, Discover, and American Express. Even ameliorate is that at that place are no monthly fees, either.

However, at that place is a different device required for contactless payments, which allows non just for chip and pin cards to be read, just besides utilise Apple tree Pay for payments.

Birthday, Square brand taking transactions a painless process, and the card reader is both like shooting fish in a barrel to use and simple to work with. The charges are very reasonable, too.

Read our total Square Reader review .

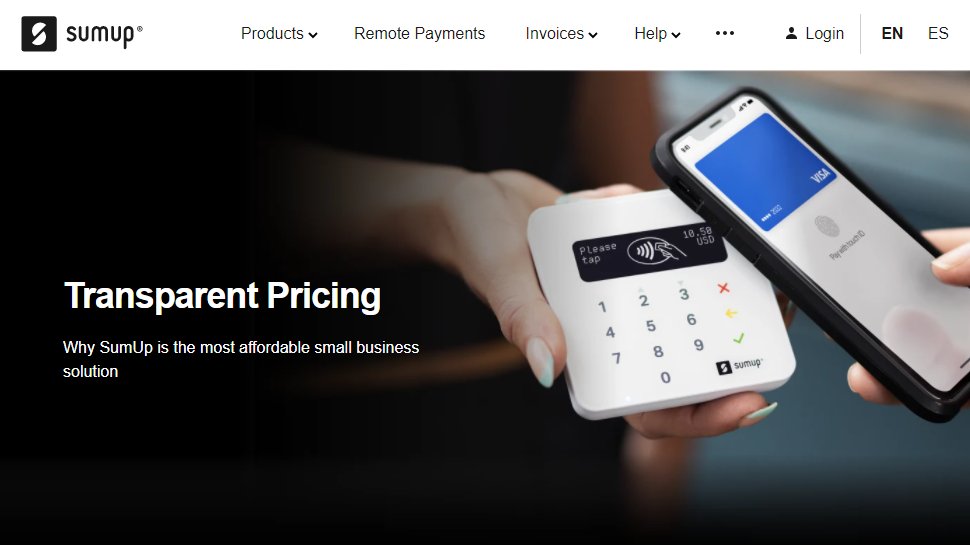

SumUp is mobile bill of fare reader that is available in 31 countries, although it is a more recent entry to the U.s.a. market. Notably, it supports cards with EMV, popularly known as the newer 'chip cards,' and is powered via a micro-USB port, and has a lithium ion bombardment.

This mobile card reader solution is well suited to lower volume users as it offers a stock-still transaction cost, with no monthly fee, or minimum usage level. The card reader connects via Bluetooth to your smartphone with a downloadable app.

There is also support for a wide variety of credit cards, including MasterCard, Visa, American Express and Observe Card, besides as the newer services Apple tree Pay and Google Pay. Payouts to your bank account have an efficient one to two days. Unfortunately, the card reader is required for whatsoever transaction to occur, every bit transactions cannot exist manually entered.

Read our full SumUp review .

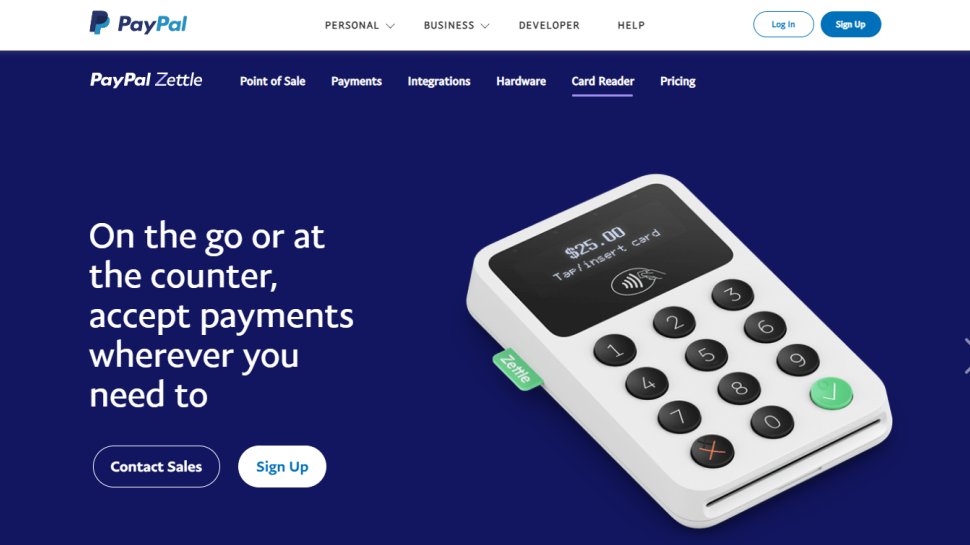

PayPal Zettle allows your mobile device to accept cards and contactless payments by using a PayPal card reader and the PayPal payment app. All you lot need to do is download the PayPal Zettle app and pair your smartphone or tablet with the carte reader.

The PayPal Zettle carte du jour reader works with the Signal of Sale app to permit you to procedure card payments by Visa, Mastercard, Amex, and Discover, too as contactless payments from Apple Pay, G Pay, and Samsung Pay.

Of course, you will need a PayPal account to run the app and card reader, and payments are fabricated into your PayPal account typically within one concern twenty-four hours. You tin can too impress or email receipts, whichever is best for your customers.

There'south a small i-time fee for the carte du jour reader, and a apartment-rate processing fee for each order.

Read our full PayPal Zettle review .

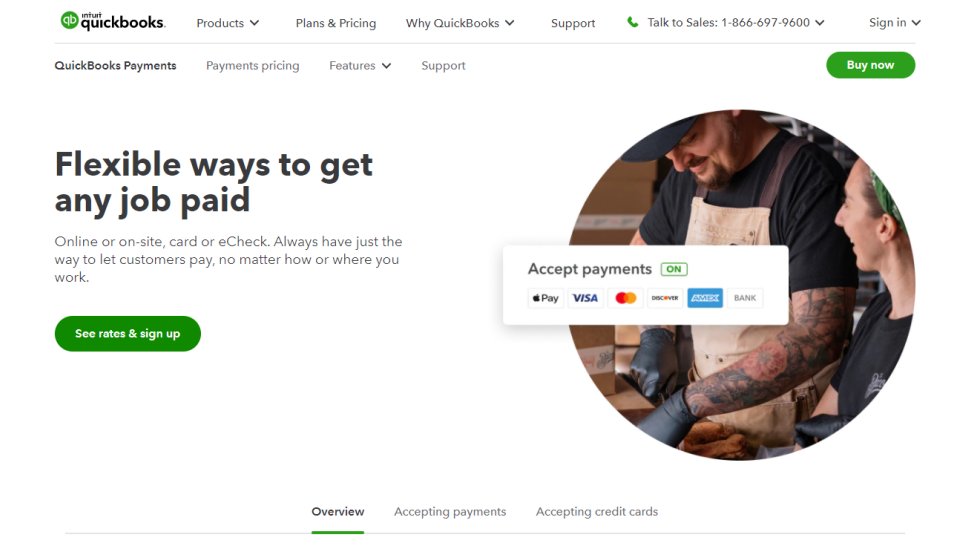

Intuit, best known for TurboTax, produces the QuickBooks minor business concern accounting offer, and nether that umbrella is its mobile card reader effort, which is known equally QuickBooks GoPayment.

The GoPayment smartphone app is notable, and this has a companion card reader, both of which come for no boosted accuse. Unlike free card readers from competing services, this one from Quickbooks can handle both mag-stripe and chip methods of entry, and connects to the smartphone wirelessly via Bluetooth.

Another benefit of this service is that at that place is no setup fee, or whatever minimum usage level, making QuickBooks more attractive for the lower volume user.

Of grade, beingness part of Intuit means that this big business organisation has produced an assortment of solutions for whatever kind of business you run. Using the app-based approach GoPayment is therefore tailored more to an on-the-go or mobile business where yous don't necessarily have the traditional bespeak of sale organisation in place. And, equally you would expect, transactions can be handled via Apple or Android devices.

Overall, if yous're already a QuickBooks user, QuickBooks GoPayment could be your priority pick.

Read our full QuickBooks GoPayment review .

Shopify will exist instantly familiar if you've always been considering an due east-commerce platform for your business as that'south where it started out. Yet, aside from catering for all kinds of business on the selling front, Shopify has also expanded its products and services and now includes mobile card reading.

In addition to the mobile card reader offering, this also integrates into Shopify solutions including the Shopify POS smartphone app. Yet, do note that the mobile reader comes as an extension to existing Shopify services, and isn't provided as a standalone.

Due to the fact that Shopify offers an array of services on what amounts to a global scale there are territorial and geographical differences when information technology comes to costs too bated from the basic WisePad 3 Reader device.

Considering the latitude of options it's a good thought to investigate them to determine which ane is going to exist all-time for your business.

Read our full Shopify review .

PayAnywhere has been in existence for around a decade or then now, although it's but in the terminal couple of years that it has been improved enough to exist chosen a serious player in the carte processing stakes.

PayAnywhere currently comes with two unlike packages for the mobile market, so currently you can opt for their pay-as-you-get packet, which covers transaction processing of nether 10k per month for swiped, dip or tap payments.

PayAnywhere caters for business organization users right across the board with a whole choice of hardware devices to let you process payments. There are smart terminals, smart betoken of sale devices and a brace of bill of fare readers. There'southward the 2-in-1 option and a three-in-1 reader unit too, as well every bit miscellaneous accessories designed to make the credence of customer funds all the more than straightforward.

Of the two readers and then the 3-in-1 obviously does that little bit more equally information technology is able to process magstripe payments (swipe), EMV chip card payments (dip) and too handle NFC contactless payments including the likes of Apple Pay and Samsung Pay. Meanwhile, the Smart Concluding can process Pivot debits, print receipts and has a born barcode scanner. Both the Smart Flex motorcar and the Smart Point of Sale hardware add on a customer facing second screen.

Read our full PayAnywhere review .

We've also highlighted the best payment gateways .

Source: https://www.techradar.com/best/best-mobile-card-payment-reader

0 Response to "Review Mobile Card Reader for Android Phones & Tablets"

Kommentar veröffentlichen